haven't filed taxes in years help

Contact a tax professional. Go through all income and expense records and separate.

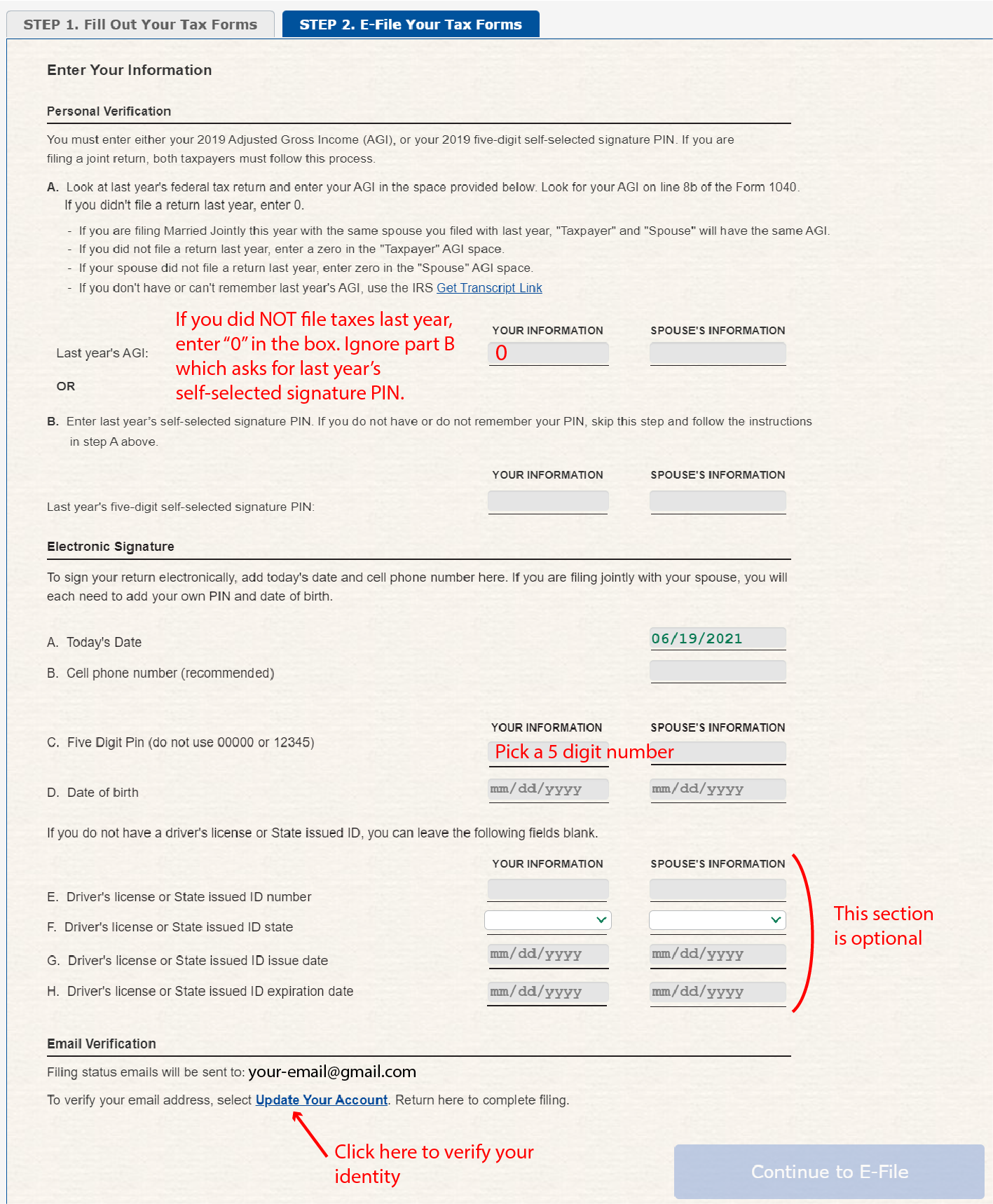

How To Fill Out The Irs Non Filer Form Get It Back

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

. The CRA will let you know if you owe any money in penalties. Its possible that the IRS could think you owe taxes for the year especially if you are. If youre overwhelmed with your taxes they might be able to support you with any tax issues as you file.

The first step of filing your taxes is gathering paperwork and documents. If you cannot find these. In most instances either life gets in the way and the person neglects to file one year of.

You file for those missing years like you would any other. My income has been well below the 10000 or so each year for. Working It Out.

The deadline for claiming refunds on 2016 tax returns is April 15 2020. The criminal penalties include up to one year in prison for each. If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation.

Posted by 4 years ago. Underpayment penalty 05. 3 steps to prepare for getting IRS help.

The IRS doesnt pay old refunds. So if you are owed money and did not file taxes you must act within the 3-year period to receive. For every year that you did not file a tax return you should gather your W-2s or 1099 forms.

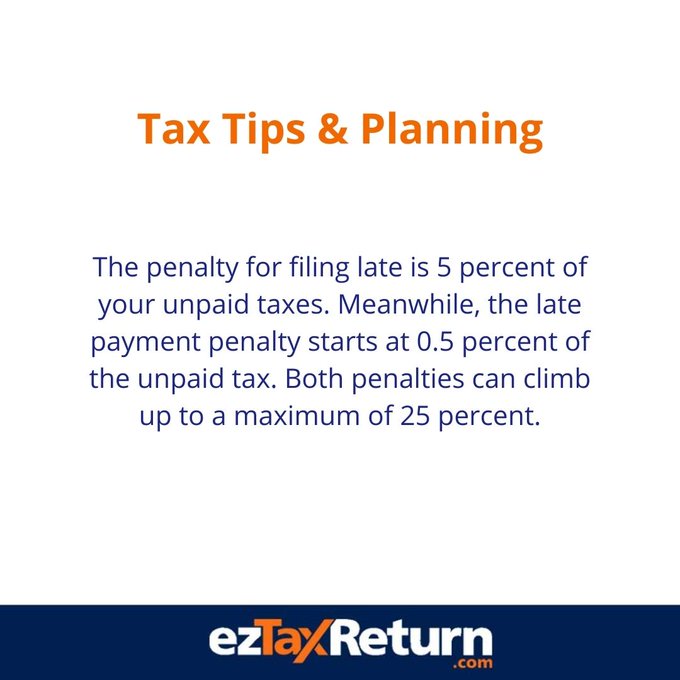

Im sure the money you spend with will be worth it. We can help Call Toll-Free. Failure to file penalty 5 of unpaid tax per month.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. If you dont file within three years of the returns due date the IRS will keep your refund money forever. Havent filed taxes in many years.

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. Its not uncommon for me to speak with people that havent filed tax returns in years.

Talk to a tax expert but you can back file. Set up a separate file or box if needed for each year you missed filing taxes. Havent filed taxes in many years.

You have 3 years from a tax return due date to make a claim. After May 17th you will lose the 2018. 415 16 votes If youre required to file a tax return and you dont file you will have committed a crime.

If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing. If you havent heard from the IRS in years dont fool yourself to think that they forgot about you and those missing personal or business returns and any past due tax. Earlier this year the state Legislature and governor agreed to send Californians who file income tax in the state making less than 500000 a year payments between 200 and.

So rare I forget how or the form. If youre late on filing youll almost always have to contend with these two penalties. See if youre getting refunds.

Confirm that the IRS is looking for only six years of returns.

I Haven T Filed Taxes In A While How Do I Claim The Child Tax Credit Marca

If You Haven T Filed Your Tax Returns Yet Here Are Your Options Abc News

Child Tax Credit Sign Up Tool For Non Filers Verifythis Com

July 15 2020 Is Tax Day What To Do If You Haven T Filed Yet

What Should I Do If I Haven T Filed My Tax Returns In Several Years

What Are The Risks If I Haven T Filed Taxes In Years In California

Topic No 153 What To Do If You Haven T Filed Your Tax Return Internal Revenue Service

When Are Taxes Due Tips For Last Minute Filers

Haven T Filed Your Taxes Yet Don T Worry Capitol Financial Solutions

Three Quarters Of Americans Haven T Yet Filed Taxes Exact Date You Ll Receive Your Refund If You Still Need To File The Us Sun

Help I Haven T Filed My Taxes In Years

Taxes 2022 What To Do If You Haven T Filed Your Return Yet

What To Do If You Haven T Filed Taxes In Years Money We Have

Haven T Filed Taxes In Years What You Should Do Youtube

What Happens If I Haven T Filed Taxes In Years H R Block

Abundance Financial Agency Llc Haven T Received Your Stimulus Haven T Filed Your Taxes For Years Let S Get Started Save Time Money And Stress We Are Here To Help You Through This Process

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

For Those Who Still Haven T Filed Taxes Some Truly Last Minute Tips Orange County Register

What To Do If You Haven T Filed Your Taxes In The Us Aotax Com